Response to Climate Change

Governance

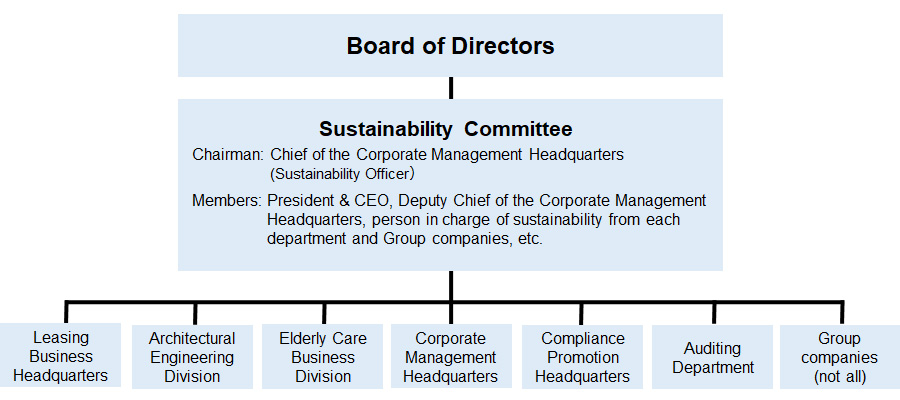

The Leopalace21 Group has established a Sustainability Committee under the Board of Directors, which meets every three months to promote initiatives related to sustainability management that the Board of Directors instructs the whole company as part of its business. The Board of Directors oversees this issue by reviewing and consulting on climate-related issues, which it has positioned as a key sustainability management issue. In the fiscal year ended March 31, 2022, the Board approved the setting of targets to reduce CO2 emissions, among others. The Sustainability Committee, chaired by the Director in charge of sustainability and composed of sustainability representatives from each department, deliberates and examines measures to promote "Attention to the environment," one of the Company's materiality issues.

Promotion Structure

Roles and responsibilities in the promotion structure

- Board of Directors

The Board of Directors determines basic management strategies and plans, and decides on measures on climate change-related issues based on deliberations by the Sustainability Committee and the Risk Management Committee, and receives reports on the relevant matters. It supervises the activities of these Committees. - Director in charge of sustainability

Leads discussions and plays a central role in advising the Sustainability Committee when the Board of Directors decides on environment-related policies, including climate-related issues. - Sustainability Committee

The status of sustainability promotion shall be shared throughout the Leopalace21 Group through reports on the status of activities related to each materiality in the areas of environment, social, and governance, which are being undertaken by the Committee members representing relevant departments and each group company as part of their business activities. In addition, the Committee shall set numerical targets for environmental activities, including climate change, and manage the status of their achievement, report on important matters to the Board of Directors, and report to the Board of Directors on the risks posed by climate change in cooperation with the Risk Management Committee.

Strategy-1

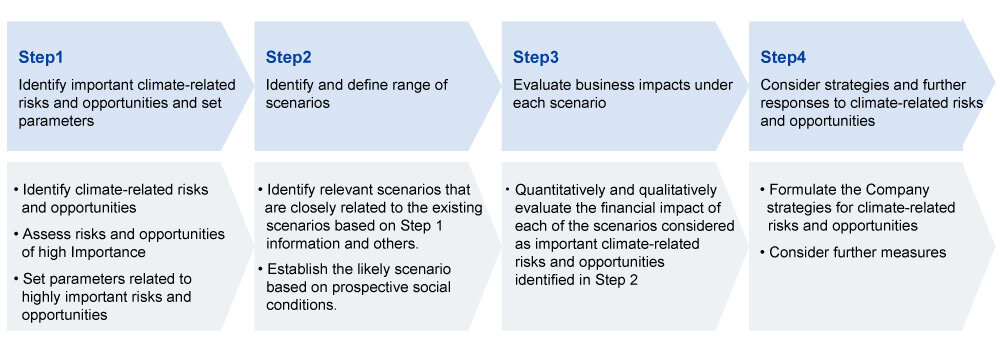

In addition to evaluating financial and business impacts under different scenarios (see table below), the Company conducted scenario analysis according to the following steps in order to examine the resilience of its strategy and response to climate change risks and opportunities, and to link the results to its future business strategies.

The scope of the scenario analysis covers the leasing business segment (apartment construction, leasing, and management), as the leasing business accounts for more than 90% of the Company's sales. In addition, since the Company has identified and announced its materiality by 2030 in accordance with the SDGs, the time horizon of the scenario analysis was also conducted assuming the year 2030.

Reference scenario

| Scenario | Outline of scenario | Major reference scenario |

|---|---|---|

| 1.5℃* | A scenario in which policies and regulations are implemented to achieve a decarbonized society and the global temperature increase from pre-industrial times is limited to less than 1.5°C. Transition risk is high, but physical risk is lower than in the 4°C scenario. | -IEA World Energy Outlook 2021 Net Zero Emissions by 2050 Scenario -IPCC RCP2.6 |

| 4℃ | No new policies or regulations will be introduced and global CO2 emissions will continue to increase. Transition risk is low, but physical risk is high. | -IEA World Energy Outlook 2021 Stated Policies Scenario -IPCC RCP8.5 |

* Parameters not specified in the 1.5°C scenario are taken from the 2°C scenario.

Scenario analysis steps

Strategy-2

Identified risks/opportunities and respective financial impacts

The Company conducted a scenario analysis and identified the following risks and opportunities. The Company has already begun to address the increased costs resulting from the carbon tax, including setting reduction targets for Scope 1 and 2. The Company will deliberate on further measures to address each risk and opportunity, such as starting development of ZEH apartments, and take appropriate actions.

| Risks/opportunities | Category | Outline | Financial impact | ||

|---|---|---|---|---|---|

| 1.5℃ | 4℃ | ||||

| Risks | Transition risks | Policy and legal | Increase in operating costs due to tighter regulations such as carbon tax | Medium | Medium |

| Technology | Increased construction costs for new properties | Large | Large | ||

| Market | Low evaluation by investors as a company with inadequate response to climate change | Large | Large | ||

| Reputation | Avoidance of trade by corporate customers due to delay in environmental response | Medium | Medium | ||

| Physical risks | Acute | Decrease in sales due to occurrence of weather-related disasters | Small | Small | |

| Chronic | Increased costs due to longer construction periods resulting from increased extremely hot days | Medium | Medium | ||

| Opportunities | Products/

services |

Increased sales due to increased demand for environmentally friendly apartments (Construction) | Small | Small | |

| Increase in sales through provision of environmentally friendly apartments (Leasing) | Small | Small | |||

| Increase in sales due to the new production lines at corporate customers which are engaged in environmentally friendly business (Leasing) | Small | Small | |||

| Resilience | Restoration demand in the event of flood or flood-related damage (Construction) | Medium | Medium | ||

Financial impact

Large: Impact on sales of JPY 5 billion or more / Significant impact on operations

Medium: Impact on net sales of JPY 500 million or more but less than JPY 5 billion / Impact on operations

Small: Less than JPY 500 million impact on net sales / Minor impact on operations

Major countermeasure

⇒ Consider responding by utilizing renewable energy for electricity and gas for managed apartments

In order to reduce CO2 emissions from our business activities, the Company considers sequentially beginning to convert the electricity and gas used by tenants in our approx. 560,000 managed properties nationwide to renewable energy. This will potentially contribute to a reduction in Scope 3 emissions for the corporate clients who use the Company's managed properties, and is also expected to reduce Scope 3 emissions for the Company.

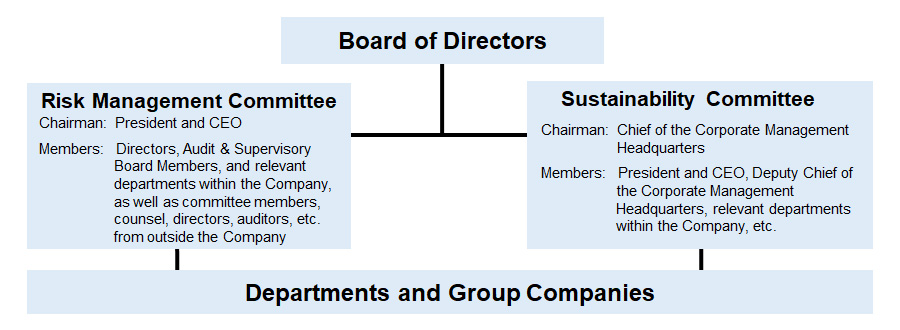

Risk management

The Leopalace21 Group has established a Risk Management Committee under the Board of Directors to comprehensively identify and manage company-wide risks. Risks are being evaluated and addressed based on six broad classifications. Climate change-related risks are positioned as "external factors" in the risk classifications. Climate change-related risks identified by the Sustainability Committee or periodically reviewed by the Sustainability Committee are communicated to the Risk Management Committee as appropriate to share them as company-wide risks. The Sustainability Committee and the Risk Management Committee will play a central role in studying, formulating, and implementing measures to address climate change-related risks in cooperation with related departments. The results are reported to the Sustainability Committee and Risk Management Committee, and are then shared with the Board of Directors.

Risk classification table

| External factors |

|

Compliance |

|

|---|---|---|---|

| Strategy/ Governance |

|

Operations |

|

| Finance |

|

Reputation | The risk of incurring losses due to reports in the mainstream media, reputation, gossip, rumors, etc. |

Risk management structure

Roles and responsibilities in risk management structure

- Board of Directors

The Board shall receive and oversee reports by the Sustainability Committee and the Risk Management Committee on the status of and response to climate change-related risk management. - Risk Management Committee

In identifying and managing company-wide risks, the Committee shall share climate change-related risks reported by departments with the Sustainability Committee as appropriate. In addition, the Committee shall comprehend such risks communicated by the Sustainability Committee. - Sustainability Committee

The Committee shall manage, operate, and review climate change-related risks as appropriate. Such items shall be shared with the Risk Management Committee as appropriate, and reported to the Board of Directors on a quarterly basis.

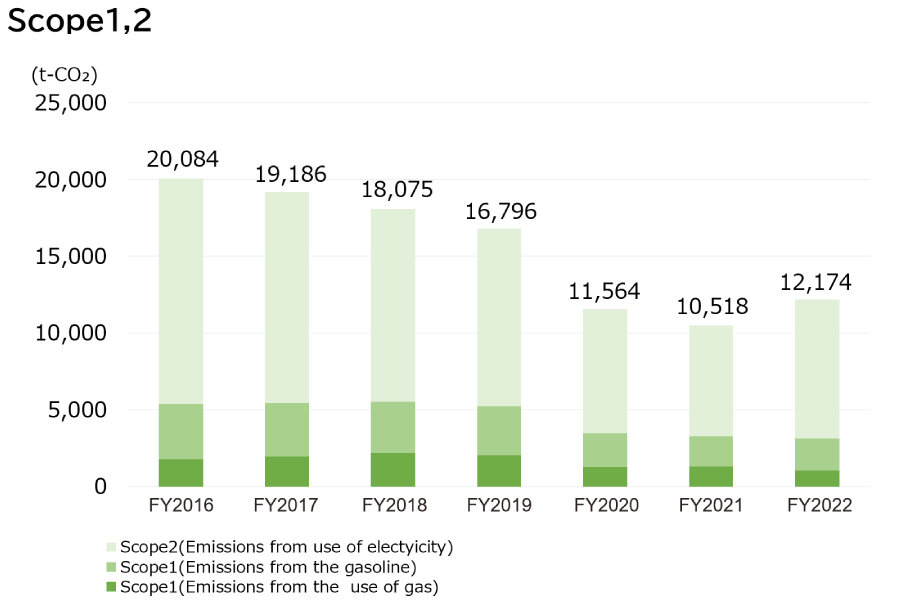

Metrics and targets

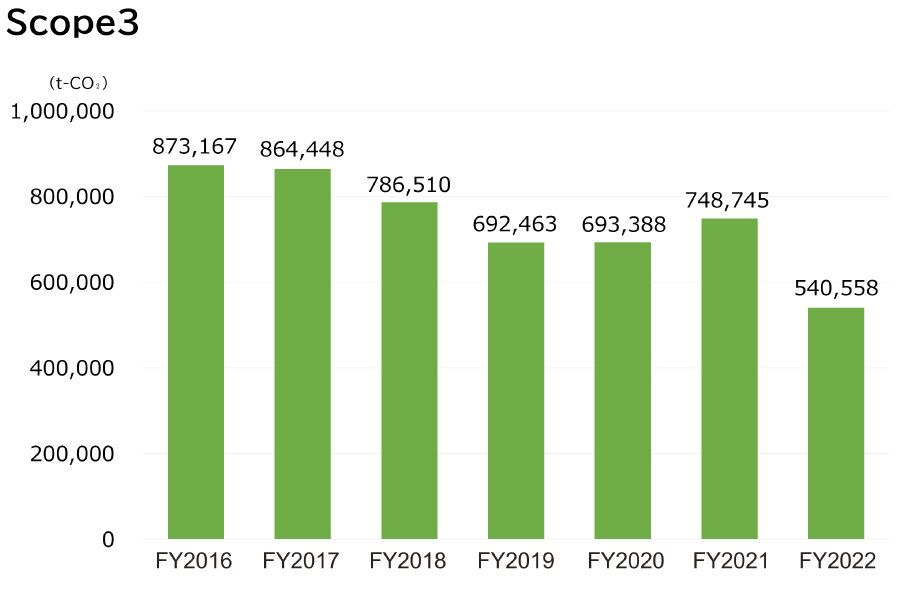

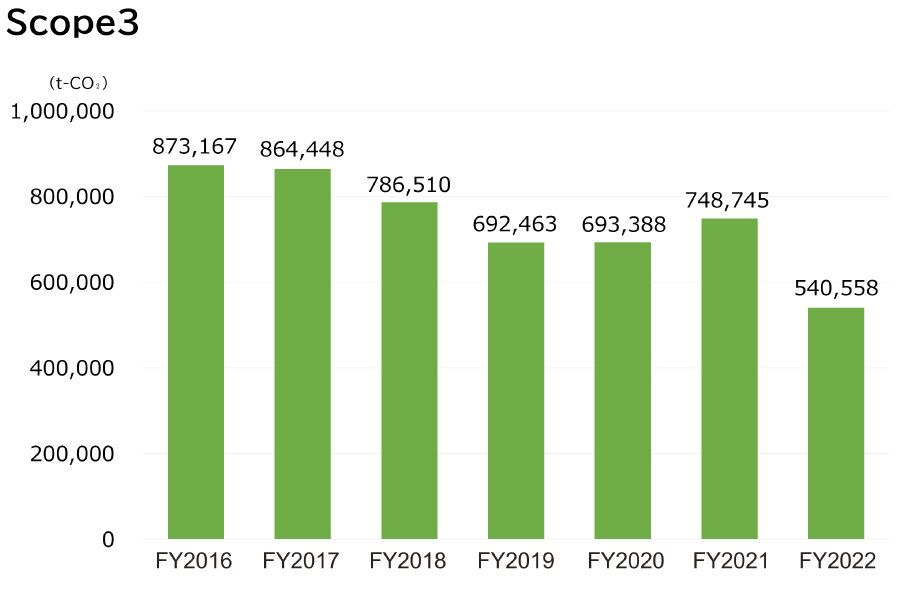

The Leopalace21 Group has started to compile and disclose CO2 emissions from its business activities since FY2016, and has disclosed the results of each fiscal year's computation on its website and in the integrated reports.

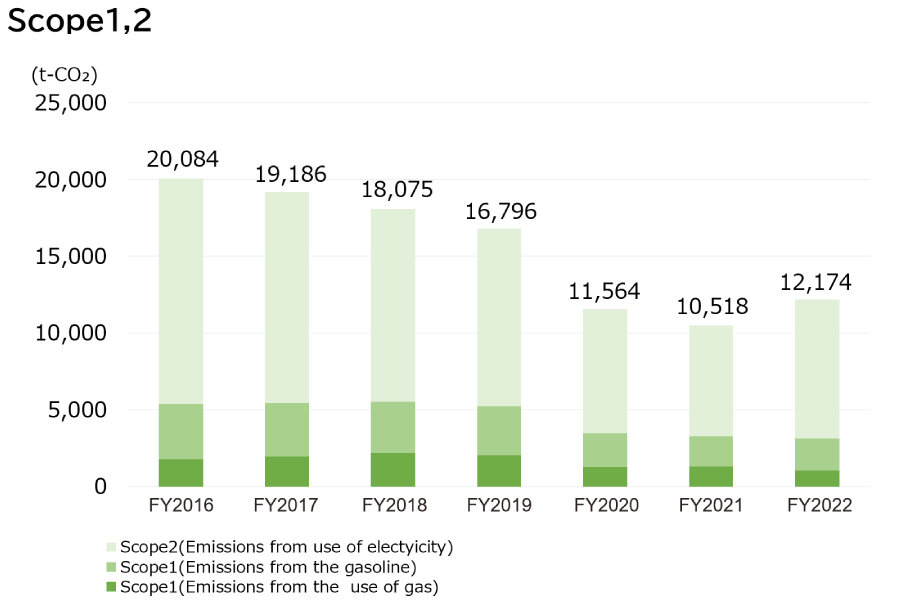

The Leopalace21 Group has set in FY2020 a target of reducing Scope 1 and 2 emissions (CO2 emissions from gas, gasoline, and electricity used by the company) from its facilities by 26% in FY2030 compared to the FY2016 level, and has already achieved this target as of the end of FY2021.

One of the major factors behind the significant reduction of CO2 emissions was the reduction of the number of leasing sales offices through implementing structural reforms in the core business and streamlining the operations through withdrawal from non-core and unprofitable businesses. The Company has changed the reduction target for Scope 1 and 2 from FY2022, and will continue to work on further reductions.

In the future, the Company will also work to identify and reduce Scope 3 (CO2 emissions indirectly generated upstream and downstream of the business activities) in order to make further contributions to environmental preservation. Since the majority of the Scope 3 emissions are derived from electricity and gas consumption by the tenants, the Company is currently taking measures such as switching to LED lighting fixtures in the managed properties. Since the Company anticipates an increase in Scope 3 CO2 emissions as the occupancy rates rise, the Company will work to further reduce Scope 3 emissions through the development and sale of ZEH apartments and the use of renewable energy in our managed properties.

Reduction target for Scope 1 and 2

Updated target from FY2022

Results of Scope 1, 2, and 3

Classification

FY2016

FY2017

FY2018

FY2019

FY2020

FY2021

Scope 1

5,392

5,467

5,518

5,218

3,473

3,284

Scope 2

14,692

13,719

12,558

11,578

8,089

7,232

Scope 3

873,167

864,448

786,510

692,463

693,388

748,745

| Classification | FY2016 | FY2017 | FY2018 | FY2019 | FY2020 | FY2021 |

|---|---|---|---|---|---|---|

| Scope 1 | 5,392 | 5,467 | 5,518 | 5,218 | 3,473 | 3,284 |

| Scope 2 | 14,692 | 13,719 | 12,558 | 11,578 | 8,089 | 7,232 |

| Scope 3 | 873,167 | 864,448 | 786,510 | 692,463 | 693,388 | 748,745 |

SERVICE SITES

-

- Clicking the links above will take you to the home page of each site.