Market Environment

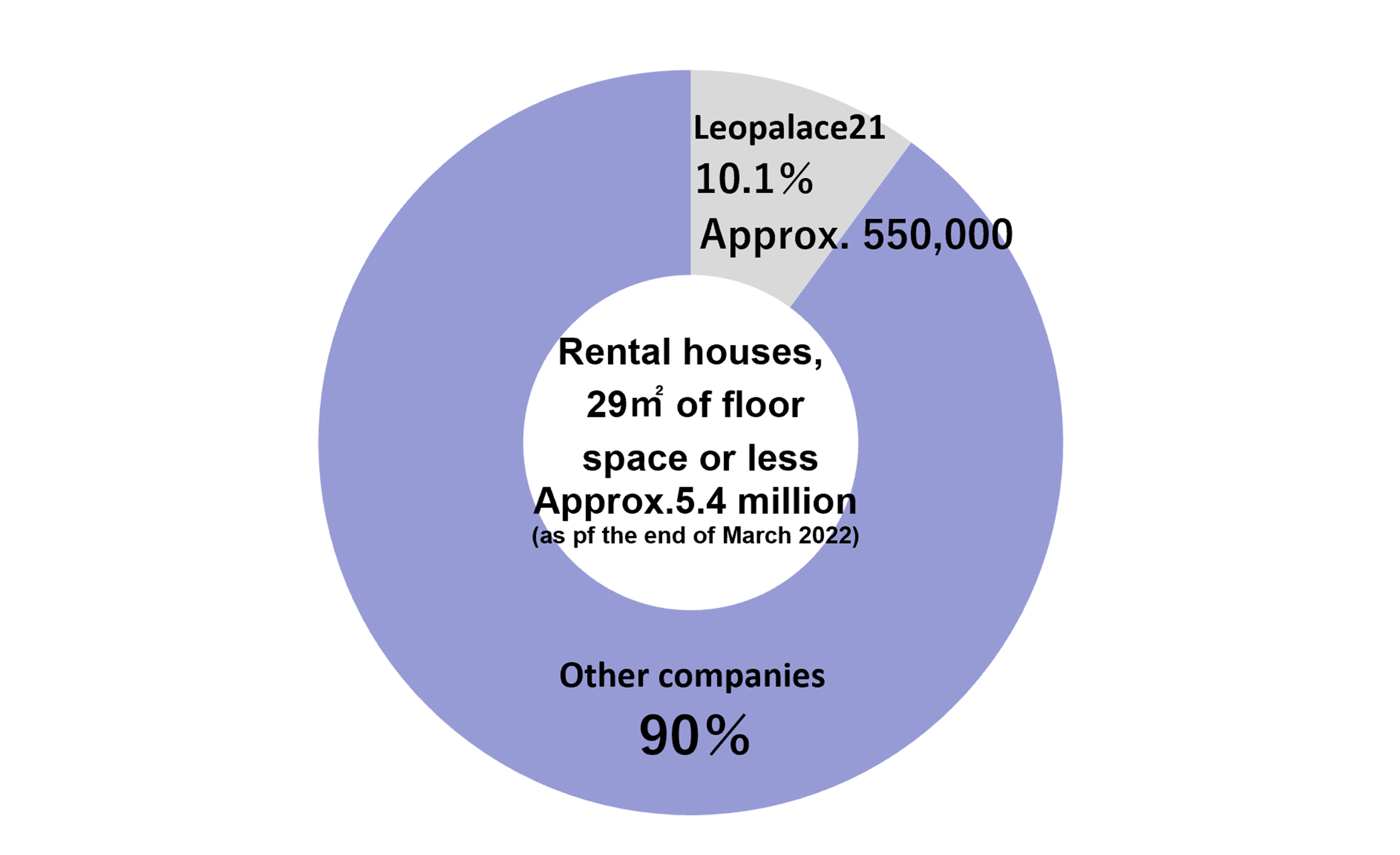

(Market Size) No. of Rental Housing for Single Households

There are approx. 5.87 million rental units of 29 square meters or less*, which is about the same size as our apartments. We manage approx. 540,000 units, and therefore the main products have a market share of 9.2% in the apartment industry for the single household market.

*Source: Land and Housing Survey 2018 by the Statistics Bureau, Ministry of Internal Affairs and Communications, Dwellings by Area of Floor Space (18 Groups) and Area of Floor Space per Dwelling by Type of Dwelling (2 Groups), Year of Construction (10 Groups) and Tenure of Dwelling (6 Groups) - Japan,

(https://www.e-stat.go.jp/stat-search/files?page=1&layout=datalist&toukei=00200522&tstat=000001207800&cycle=0&tclass1=000001207808&tclass2=000001207809&stat_infid=000040209872&tclass3val=0)(Japanese)

This material is processed and prepared by Leopalace21 based on the said data and is not prepared by the Agency.

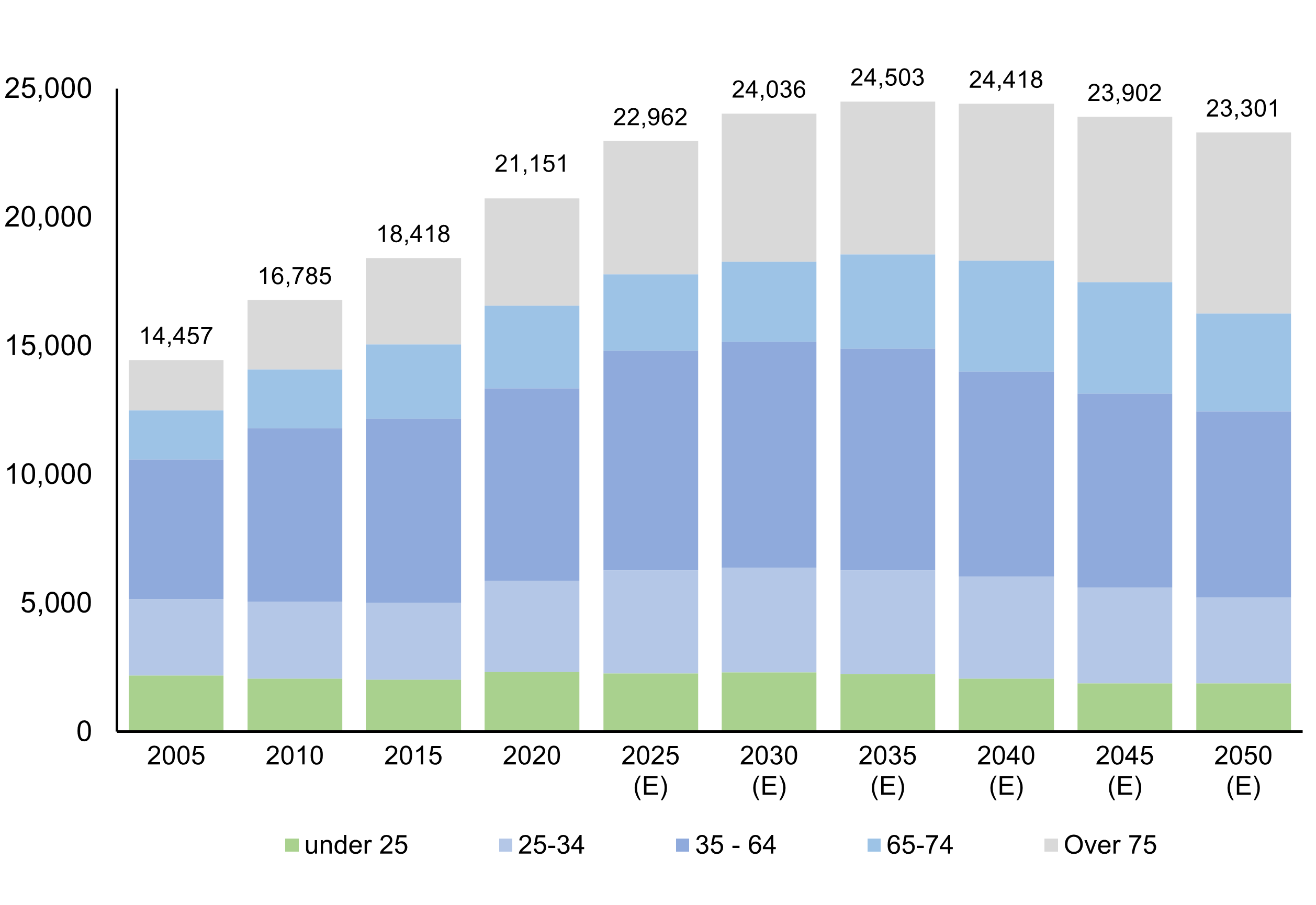

Prospects for Single Households

We have identified single households especially in urban areas as our primary target, and we make our apartments equip with facilities to meet their needs and prepare our services accessible to lead to contract signing.

Although Japan's population peaked in 2008 and began to decline, the number of single households, our primary target, is expected to continue to rise until 2035, and the external environment will remain unchanged for sustainable growth of the Leasing Business.

Source: National projection of the number of households in Japan for 2024 by National Institute of Population and Social Security Research (https://www.ipss.go.jp/pp-ajsetai/j/HPRJ2024/t-page.asp)(Japanese)

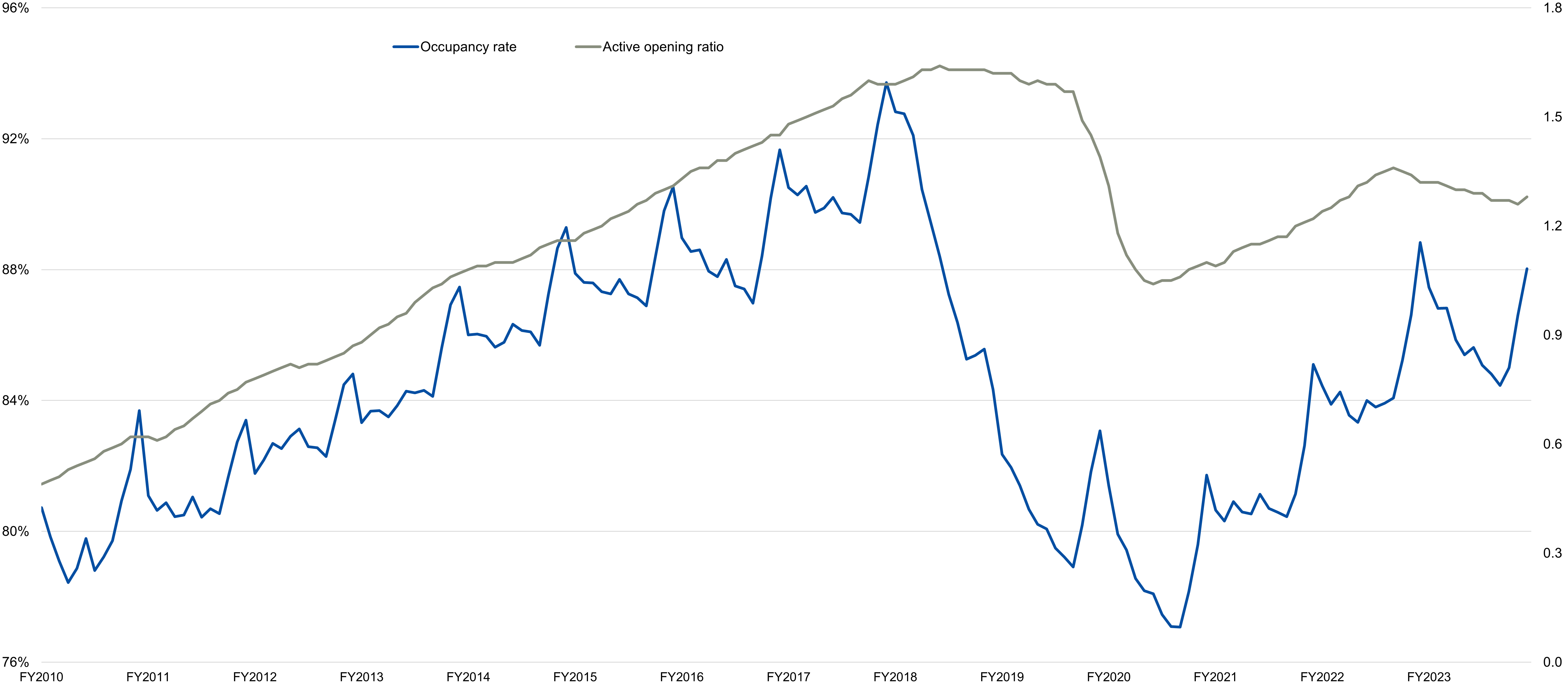

(Demand by Corporate Customers) Occupancy Rate and Active Job Opening to Applicant Ratio

Demand for Leopalace21 apartments is growing as corporate hiring becomes more active.

The recruitment market is booming after COVID-19 pandemic, and demand for our apartments, many of which are used as company-leased housing, is expected to grow further.

Source: General Employment Placement Situation (Employment Security Service Statistics), (e-Stat)(https://www.e-stat.go.jp/en)

This material is processed and prepared by Leopalace21 based on the said data and is not prepared by the ministry or agency.

As approximately 65% of our tenants are corporate clients, employment situation of the companies is one of the most important factors for us.

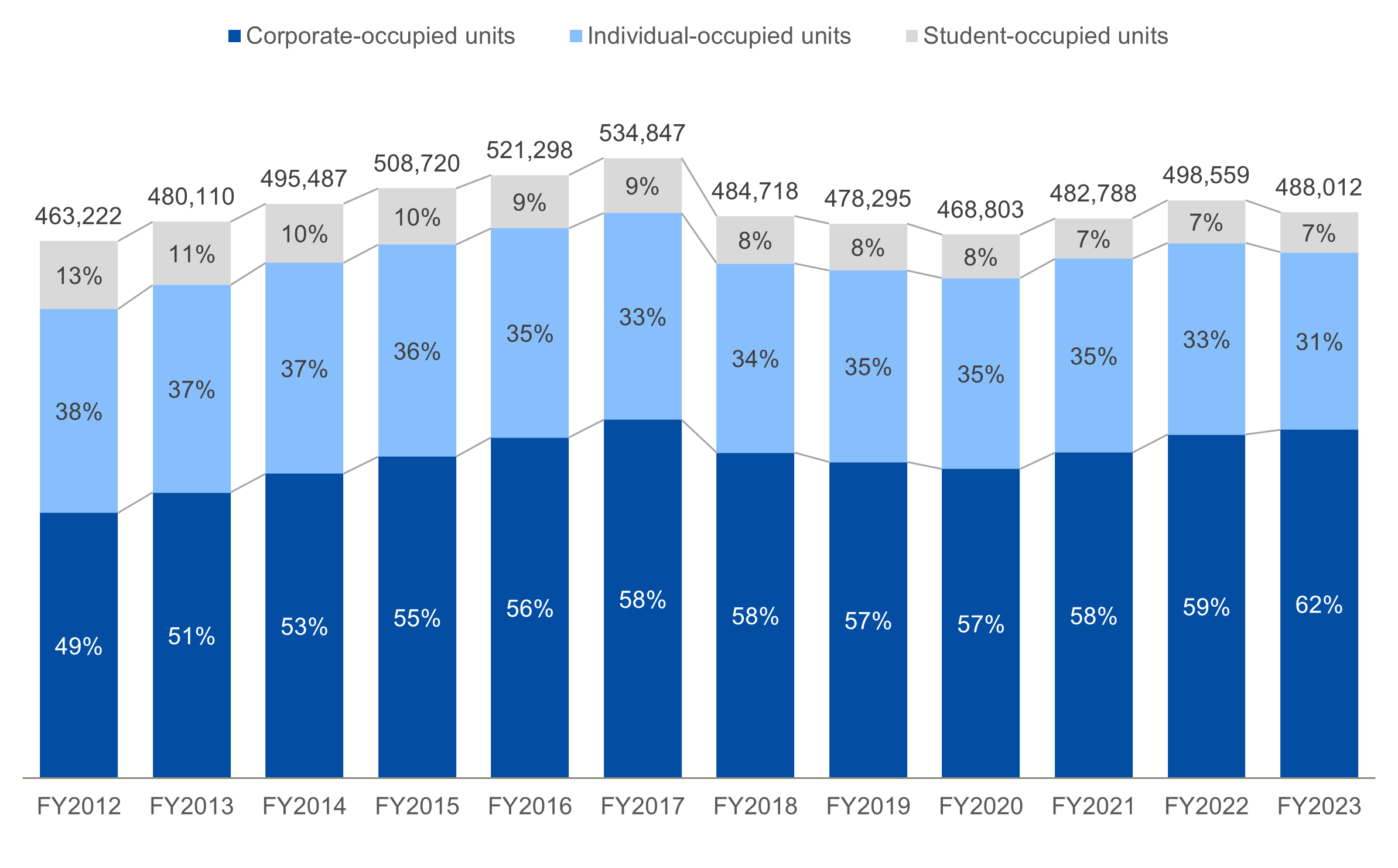

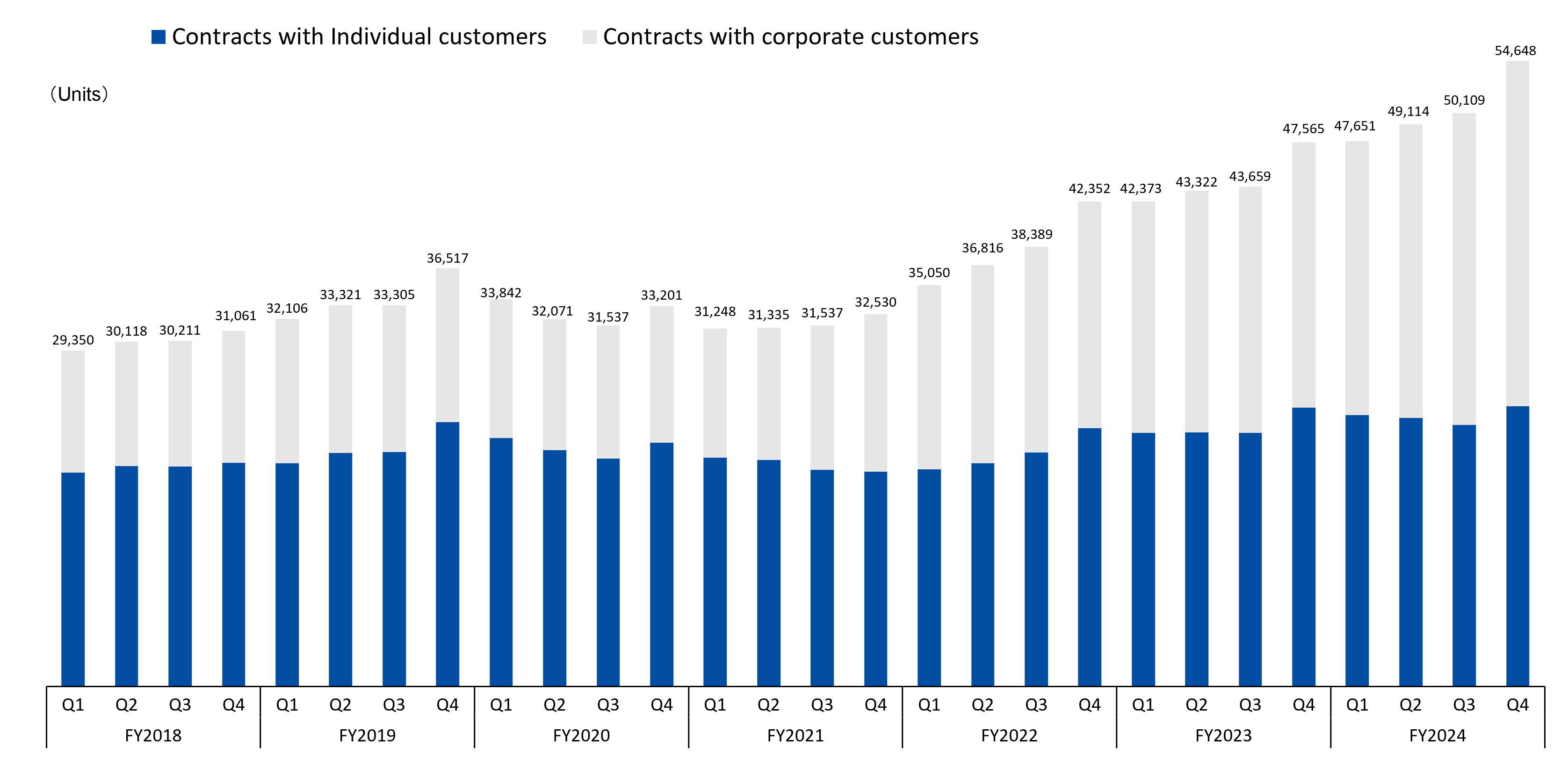

▼Number of apartment units used by tenant category

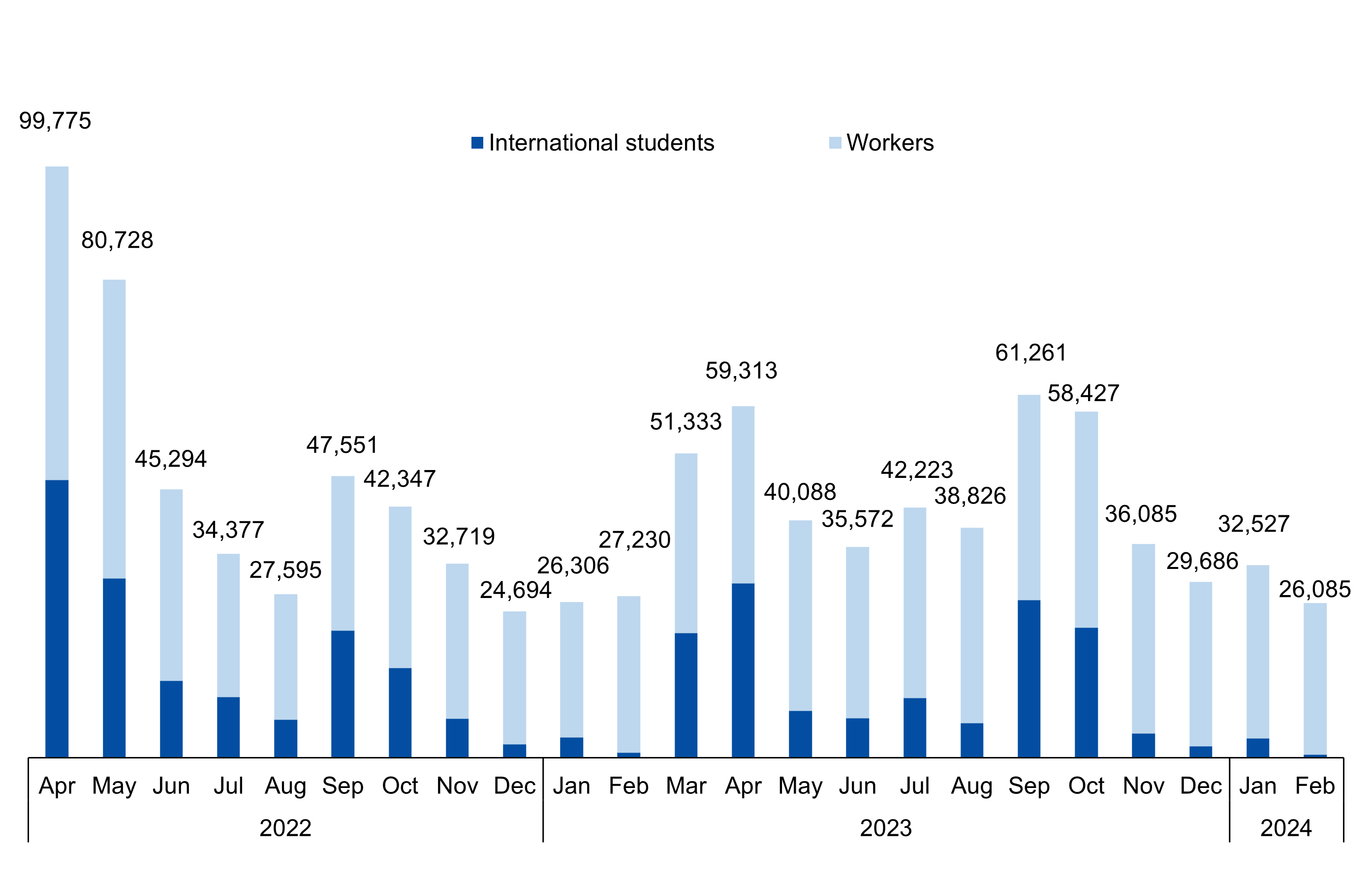

(Demand by Foreign National Customers) Changes in the Number of Foreign National Workers and International Students

As the impact of the COVID-19 began to ease, the number of foreign nationals entering Japan has shifted to an upward trend.

Furthermore, due to the recent labor shortage, foreign nationals are increasingly being hired.

*¹ Source: Number of foreign entrants and Japanese departing from Japan in 2024 (preliminary figures) by Immigration Services Agency (https://www.moj.go.jp/isa/publications/press/13_00050.html?hl=en)(Japanese)、e-Stat(Immigration Statistics)(https://www.e-stat.go.jp/dbview?sid=0003288049)(Japanese)

*² Source: Number of foreign residents as of the end of 2024 by Immigration Services Agency(https://www.moj.go.jp/isa/publications/press/13_00052.html?hl=en)(Japanese)、e-Stat(Number of foreign residents at the end of 2024)(https://www.e-stat.go.jp/dbview?sid=0004019020)(Japanese)

This material is processed and prepared by Leopalace21 based on the said data and is not prepared by the ministry or agency.

Against a background of accelerated hiring of foreign nationals to fulfill the labor shortages, the number of units used by foreign national tenants is increasing every year, with a particularly marked increase in corporate contracts.

-

Page access ranking

January 1-31, 2026

-

Leopalace21 is working to solve a wide variety of social issues with the aim of creating a sustainable society under the sustainability vision of "We go on creating new value for society today and in the future."

SERVICE SITES

-

- Clicking the links above will take you to the home page of each site.