- HOME

- Information for Investors

- IR Materials

- Integrated Report

- Message from the President

Reforms with survival at stake,

and effects on the restoration of trust

Companies always face demands to change with their external environment. Our company, with its very survival at stake following the construction defects problem, further had to face up to transformation in every aspect, including our internal organizations and ways of doing business. Since announcing our implementation of structural reforms in June 2020, we have worked to review our business strategy as well as radically improve our financial soundness to enhance our corporate value.

To restore trust in our company, we have no choice but to face up to the mistakes we have made and march steadily forward. On this point, I feel some positive outcomes. I believe that these have been recognized by society, which in turn opens up new actions for us. These include the ability to borrow from financial institutions and carry out refinancing.

to open up a future.

The key to this is employees

thinking and acting on their own.

Aiming to be an "employee-centered" company

Leopalace21, built by a founder who exerted strong leadership, was managed in a top-down style from its headquarters for many years, without developing a culture by which employees think and act on their own. I believe that this form of organization was one cause behind the construction defects problem.

Our business, which has properties nationwide and deals with tenants, property owners, cleaning companies, and other business partners in every region, cannot be conducted solely within headquarters. Accordingly, I believe we need to respect regionality and the judgment of sites in the field. Because of this, I have felt uncomfortable with our company's top-down management style ever since I joined. As I am not the type to lead the organization through strong-arm methods, I decided to make this a bottom-up company in which employees think and act on their own. We are currently undertaking a transformation aimed at becoming an "employee-centered" company.

The concept of an "employee-centered" company was proposed by a team in response to a call for management proposals. Rather than simply implementing the decisions of upper management, employees consider the direction of the Company and take action themselves. This concept of seeking transformation of our corporate culture aligned with my own thinking, so I made it a cornerstone underlying our promotion of reforms aimed at a new Leopalace21.

With rebranding for the purpose of rebirth as our aim, we gave the concept concrete form through the formulation of our employee-led MVVC (Mission, Vision, Value, Credo). The team that proposed the Company's concept of "employee-centered" formed the secretariat for the project. We called for volunteer candidates, from which we selected 11 persons of differing departments, ages, job positions, and other attributes. With this team in place, we began discussions. The employees themselves shaped the philosophy, with no involvement by executives. I think that the process, something akin to an indirect democracy in which representatives working in the field hold discussions and report outcomes back to their departments, was meaningful to the employees as an experience in management participation.

Through this bottom-up project, we created our mission of "To create new value and imagineer joyful living" and our vision of "To shape the future of 'Single Living' by connecting with people, companies, and communities to make everyone's lives brighter through the concept of 'Living Freely and Confidently'." From here on out, I believe that we need to spread this philosophy throughout the organization, and must get all employees to understand its values and connect those to their own actions.

Dialogues with work sites as the starting point for transformation

Among the reasons for aiming at an "employee-centered" company, one was that, following the construction defects problem, employees had lost confidence and pride in working for Leopalace21. Under such conditions, there was no hope for business performance to improve. I viewed our employees as the sole driving force that could cut off this negative spiral and open up a future for our company.

To engage in face-to-face dialogues with employees, we held town hall meetings in which executives visited remote branches across the country. These focused on sharing information concerning financial results, management policy, work progress, achievements, and other topics. I believe that recovery in employees' confidence was greatly aided by their realization that our company was steadily carrying out business divisions' policies and that results were becoming apparent. From the employees, we heard requests regarding in-house programs and frank opinions on front-line issues unseen by headquarters. In many cases, this feedback has led to reviews of programs and effective measures.

Progress status of our structural reforms

Our company's brand message is "People never forget the room where it all began." This message expresses the mixed hopes and anxieties that we all feel when undertaking that new step of "Single Living." This thought is a driving force behind our support for society. Our company, which manages over 540,000 rooms across Japan and provides a starting place for people, recognizes that we are truly a part of social infrastructure.

In 2019, when my inauguration as President and CEO was announced during a difficult period, I said, "I have an awareness of our company as shouldering social infrastructure. That is why I want to make a new start for our company, as one needed by society." I hold that same wish even now. It is no exaggeration to say that our company, which provides rooms fully equipped with furniture and appliances to enable an immediate start from a single piece of luggage, is a part of the infrastructure needed by society.

Holding this awareness, we have sincerely faced up to the construction defects problem and have worked to regain trust. In the structural reforms we announced in 2020, we decided to place our focus on restructuring our core Leasing Business. The business initially faced a sharp drop in occupancy rate and suffered losses. In fiscal year 2024, however, the Leasing Business's operating profit recovered to exceed JPY 35 billion. While not all of the issues faced by the Leasing Business have been resolved, its business performance is undergoing a smooth recovery.

At the same time, to focus on addressing the construction defects problem, we all but suspended the Development Business in terms of providing new properties and renovating properties of renewal age. This created an ongoing situation in which a major pillar of our company was lost. We are resuming the Development Business in earnest from fiscal year 2025 as we take a step toward a truly Comprehensive Leasing Management Services Provider.

We are undertaking operational reforms in our Elderly Care Business, which remains unprofitable at present. In Other Businesses, we will make improvements to operating income and expenditures in the Leopalace Guam Corporation Resort business as we carry out our policy of transfer and withdrawal.

Looking back on fiscal year 2024

In fiscal year 2024, our company recorded net sales of JPY 431.8 billion and operating profit of JPY 29.2 billion. The Leasing Business accounted for about 96% of net sales. Although occupancy rate declined slightly from the previous year, average unit rent increased under our price-focused strategy, with the result that net sales increased to 102% the level of the previous year.

In Japan, where deflation has continued, rents remain at levels lower than the rapidly rising rents of major overseas cities. This has led foreign investors to note a need to raise rents. However, as doing so would unquestionably lower our occupancy rate, we believe that we should avoid simple rent hikes that fail to consider this balance. Against this backdrop, we have adopted a price-focused strategy of setting appropriate prices matched to needs and have further focused on expanding corporate use, for which pricing carries a lower priority than in individual use. The success of this approach can be seen in the increase in our top line.

The provision of housing for foreign human resources was another driving force behind our recovery of profitability. Japan, which faces a declining population and shortages of labor, is forced to rely on foreign workers in its labor force. Despite this, foreigners in Japan often face refusal to rent rooms, thwarting companies' recruitment efforts. Our company, which wields the ability to conclude master lease contracts with apartment building owners and decide on tenants as the lessor, is able to provide rooms to foreign nationals in a form by which we bear all responsibilities, including for delinquent rent. Currently, about 50,000 tenants, representing 11% of the total number of units in use by our company, are foreign nationals. We see considerable room for expansion in this area.

Accordingly, we have entered into cooperative relationships with prefectures including Osaka, Kumamoto, and Kochi to provide housing for foreign human resources. Through the provision of housing, we will continue working to resolve regional issues such as labor shortages and contribute to the realization of a society in which diverse people live together peacefully.

Business strategy under the Medium-Term Management Plan

Our Medium-Term Management Plan sets a policy of enhancing profitability and further increasing occupancy rate in the Leasing Business, with a focus on corporate use. We aim to establish a position as the brains behind the company-leased housing strategy, grounded in support for companies' human capital strategies. We aim to increase the share of the corporate use from 64.6% in fiscal year 2024 to 70% in fiscal year 2029.

In individual use, where recovery in tenant numbers is lagging, our policy is to again focus on students. Our properties with furniture and home appliances suit the needs of students as they embark on Single Living. We will work to rebuild the individual use business in conjunction with university student associations and other partners.

While single households will steadily increase, there is excess supply of apartment units and overall vacancies are not expected to decrease. What is demanded in such a situation is quality of service. In addition to our traditional offerings of rooms equipped with furniture, home appliances, and Internet access, we provide new services that increase convenience for tenants, such as smart locks and online contract signing.

With regard to the resumption of the Development Business, we will maintain a number of managed units and lower properties' average age to strengthen profitability. At the core of development will be the rebuilding of apartment buildings that were constructed by their owners 20 to 30 years ago and that have been rented and managed by our company. Rebuilding is an adventure for owners, some of whom naturally consider it unnecessary. However, we propose rebuilding as a solution. Our role is rewarding those owners who have put trust in our company and who have managed their apartment buildings together with us. As the Chief of the Development Business Headquarters, I plan to set up opportunities to explain rebuilding to these owners.

Management that is conscious of capital costs

To enhance our medium- to long-term corporate value, our company undertakes management that considers the capital costs and our share prices. To achieve sustainable growth, enhance our corporate value, and meet the expectations of stakeholders, we are transforming our business structure with an emphasis on optimal allocation of management resources and improvement of capital efficiency.

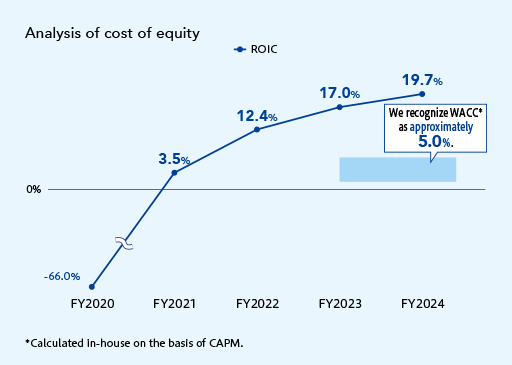

In working to enhance our corporate value, we employ management indicators including ROIC, WACC, and PBR in our management decisions. We recognize our WACC to be about 5.0%. Our business performance entered a stable phase in fiscal year 2023, and our ROIC has since maintained a level far above WACC. In our Medium-Term Management Plans, too, we will continue striving for the maximization of corporate value through efficient and strategic growth investments.

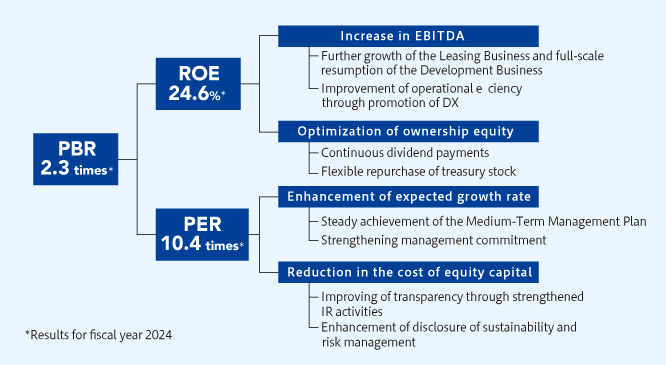

With regard to PBR, we are working to efficiently enhance our corporate value by breaking down PBR into ROE and PER and sorting out the factors that improve each of these. In working to enhance our corporate value, we are advancing measures to raise ROE and PER under the themes of increasing EBITDA, optimizing ownership equity, enhancement of expected growth rate, and reduction in the cost of equity capital.

With regard to shareholder returns, we are aiming for a dividend payout ratio of 30% in the final fiscal year of our Medium-Term Management Plan. Because we implemented a TOB of treasury stock following the announcement of our Medium-Term Management Plan, I believe that reconsideration of this ratio is in order. However, we ultimately aim to achieve a ratio of 30%.

The background to our treasury stocks TOB

In November 2020, we raised funds through the Fortress Investment Group. We did so via a number of means, including a capital increase through third party allocation of common stocks, borrowing of JPY 30 billion, and issuance of stock acquisition rights. The deadline for the borrowing and the stock acquisition rights is November 2, 2025, requiring that we repay the amount borrowed and exercise the stock acquisition rights by the said date.

With regard to the borrowing, in March 2025 we switched from a secured to an unsecured loan through refinancing with Mizuho Bank, thereby improving the soundness of our financial structure. With regard to the stock acquisition rights, the exercise of the rights by investors within the term is assumed to be nearly certain. This would cause an addition of about 160 million shares, equivalent to about 1.5 times the number of shares outstanding, with the share dilution theoretically triggering a roughly 25% decline in share price.

As a countermeasure, we decided to conduct a takeover bid (TOB) of treasury stock to settle the stock acquisition rights and avoid the dilution. Through this, we were able to achieve both stabilization of our capital structure and preservation of shareholder value.

Transition to a regional branch structure and human capital management

We are now preparing a transition to a regional branch structure that will let us flexibly respond to region-specific market environments and customer needs. I believe that holding responsibility and authority for a specific area will enable these offices to provide value more closely aligned with customers. To grow our company under the regional branch structure, it is vital that every employee hold an awareness of our "employee-centered" approach and engage in the region's business from a managerial perspective. The challenge for us will be to raise the level of employees' managerial mindset as they undertake trial-and-error-based work that lets them feel how their own actions impact profitability.

Toward that end, we will also focus on our training programs as a component of our human capital management. In addition to our ongoing sales training, we will introduce programs that nurture a managerial perspective and programs related to team building.

Sustainability strategy

We believe that the wellspring of corporate value lies in achieving both economic value and social value. To do so, we are advancing sustainability management that integrates the environment, society, and governance (ESG).

- Environmental

initiatives -

Led by Leopalace Green Energy Corporation, we are working to leverage the merits of virtually zero CO2 emissions to reduce the CO2 emissions of our managed properties. For fiscal year 2030, we have set a goal of cutting Scope 1 and 2 greenhouse gas emissions by 46% from the level of fiscal year 2016.

In the area of gas supply, the setting of prices by existing propane gas businesses involves opaque practices as well as issues surrounding convenience and the burden on tenants. In response, we partnered with a major player in the gas business to establish a new gas supply company. Through this, we will reduce the burden placed on tenants.

- Social and governance

initiatives -

With a grounding in the concept of human resources as the wellspring of competitiveness, we are accelerating our investment in human capital and are working to acquire diverse human resources, reform work styles, and promote well-being management.

Governance, too, is a foundation of sustainability management. We are taking action to engage in dialogue with stakeholders, assure effectiveness in our corporate governance, and strengthen our compliance.

- Promotion of DX

-

By moving viewings of units and contract-signing online and by introducing means such as smart locks to eliminate the need for tenants to visit our sales offices, we are increasing convenience for tenants while reducing sales office operating costs and optimizing staffing. Through measures including the partial replacement of 24-hour, 365-day telephone service with chatbot in apartment building management work, we are actively tackling efficiency and automation in our internal operations.

In closing

In leading the new Leopalace21, I want to build a company that again earns the trust of all and continues to grow. We will continue marching forward with integrity and the recognition that we form a part of social infrastructure, creating new value by focusing the strength of every employee to connect people, companies, and regions through the provision of housing. To all of our stakeholders who have supported the progress of our rebirth, I ask for your continued support.

shoulders social infrastructure,

we will connect people,

companies, and regions to

achieve new value creation

with integrity.

-

Page access ranking

February 1-28, 2026

-

Leopalace21 is working to solve a wide variety of social issues with the aim of creating a sustainable society under the sustainability vision of "We go on creating new value for society today and in the future."

SERVICE SITES

-

- Clicking the links above will take you to the home page of each site.