Implement Management that is Conscious of Capital Costs and Stock Prices

We are implementing management that is conscious of capital costs and stock prices to enhance corporate value over the medium to long term.

In order to achieve sustainable growth and enhance corporate value, as well as to meet stakeholder expectations, we are transforming our business structure

while focusing on the optimal allocation of management resources and improving capital efficiency.

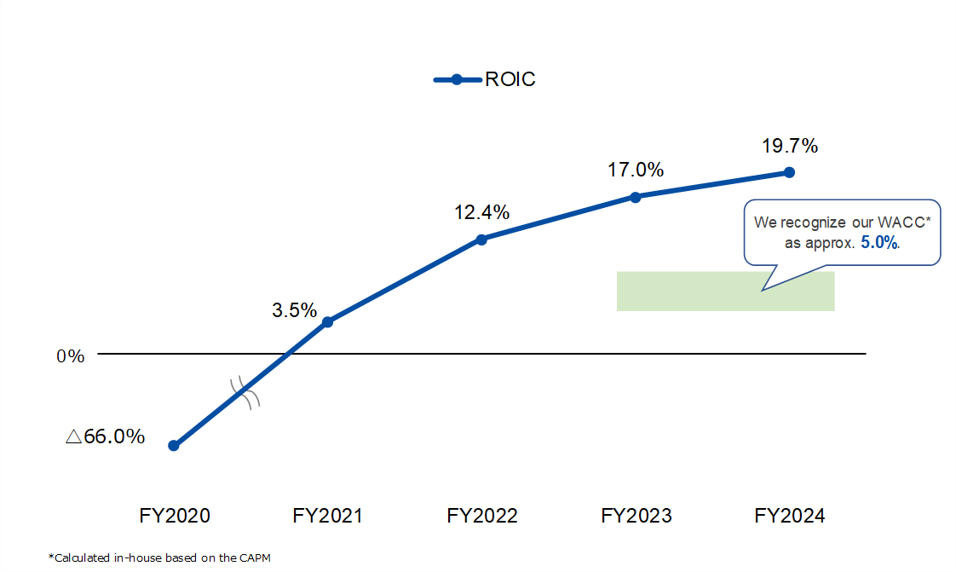

In addition, in our efforts to enhance corporate value, we consider key management indicators such as ROIC, WACC, and PBR to be crucial and utilize them in our decision-making processes.

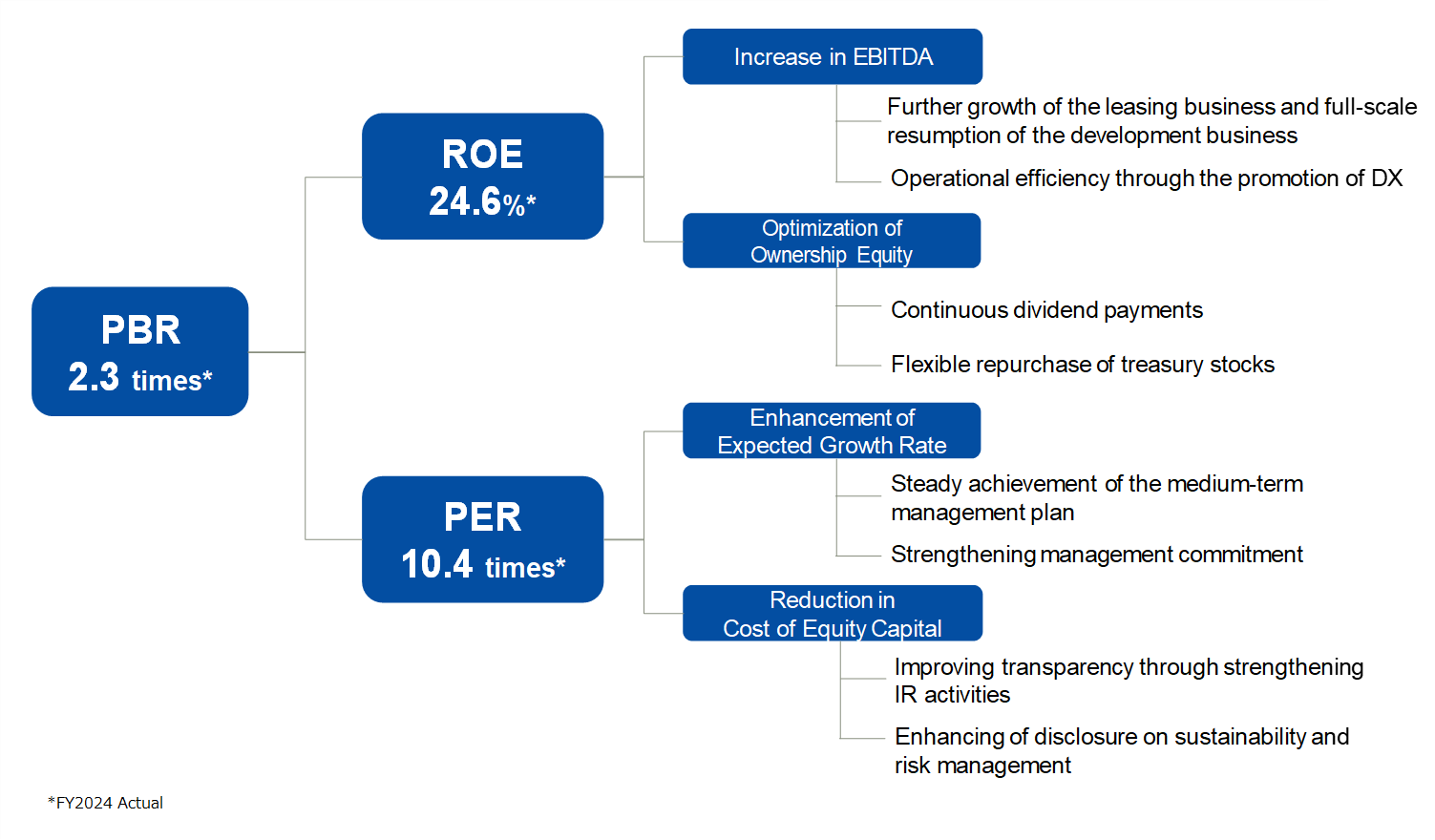

PBR Logic Tree

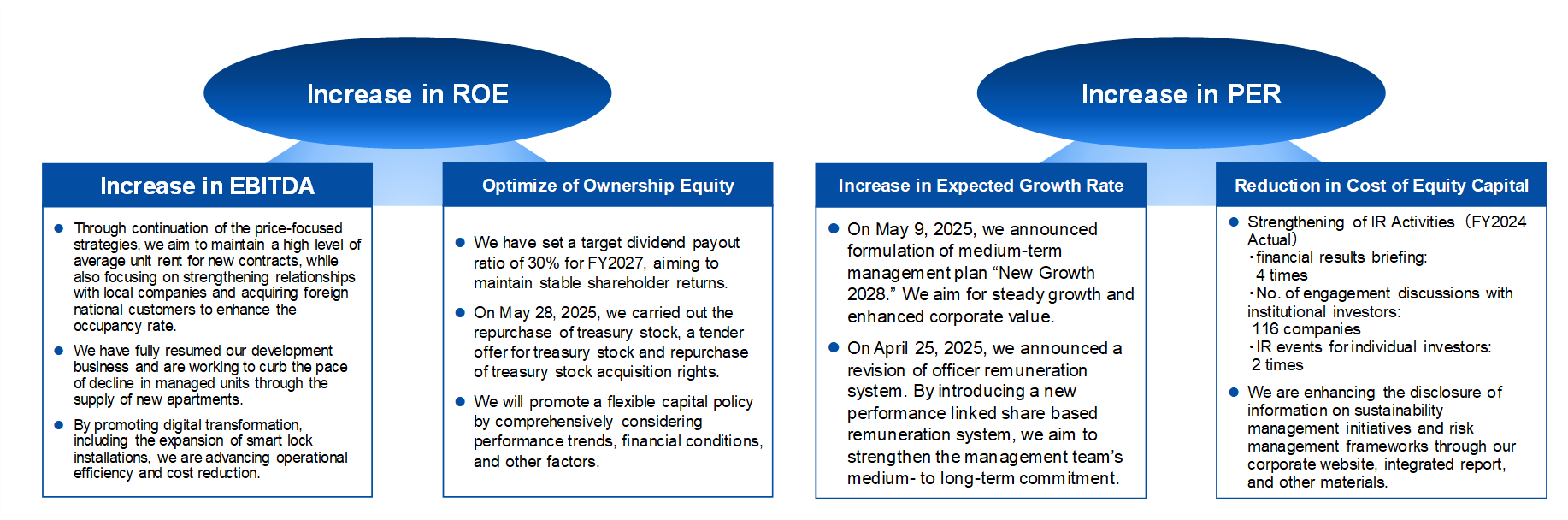

We aim to enhance corporate value efficiently by decomposing PBR into ROE and PER, and organizing the key drivers for improvement in each indicator.

In particular, we regard Increase in EBITDA, Optimization of ownership equity, Enhancement of expected growth rate, and Reduction in cost of equity as the primary drivers.

-

Page access ranking

January 1-31, 2026

-

Leopalace21 is working to solve a wide variety of social issues with the aim of creating a sustainable society under the sustainability vision of "We go on creating new value for society today and in the future."

SERVICE SITES

-

- Clicking the links above will take you to the home page of each site.